Annual Withholding Tax File to the Israeli Tax Authority (form 856)

- Dan Wolf, CPA (Isr.)

- Mar 5, 2018

- 1 min read

The Annual Withholding Tax File to the Israeli Tax Authority (form 856) is due by the end of March.

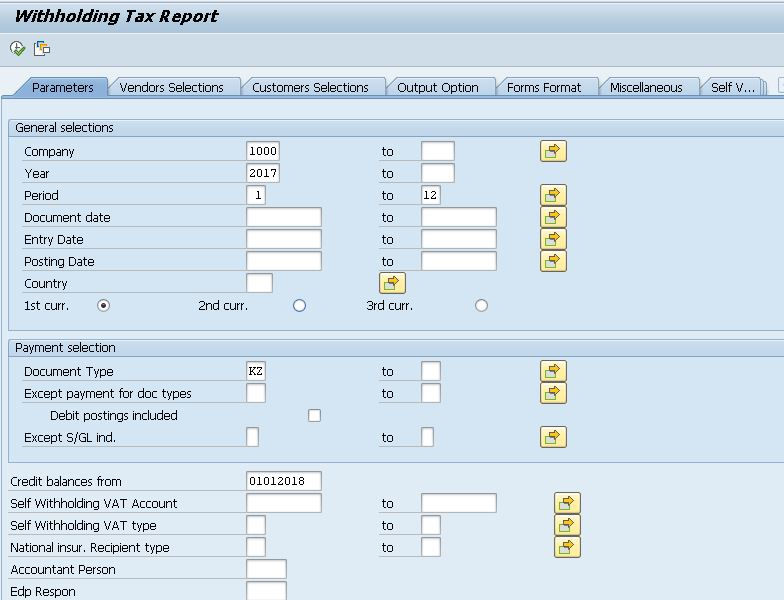

The report is issued as a text file in a predefined format, and it lists the payments and tax amounts for each supplier. In addition, the filer is obligated to issue to each of its suppliers an Annual Withholding Tax Certificate.

SAP IL localization provides a program to produce the 856 report and the supplier certificate.

However, there are cases which require expertise to validate the file completeness and to correct an invalid file (negative amounts due to line splitting, missing master data, invalid reporting of tax deduction to foreign suppliers, etc.).

Allegro-Pro offers localization consulting and automated tools for 856 form corrections.

For more information please contact: info@allegropro.co.il

More useful links:

Comments